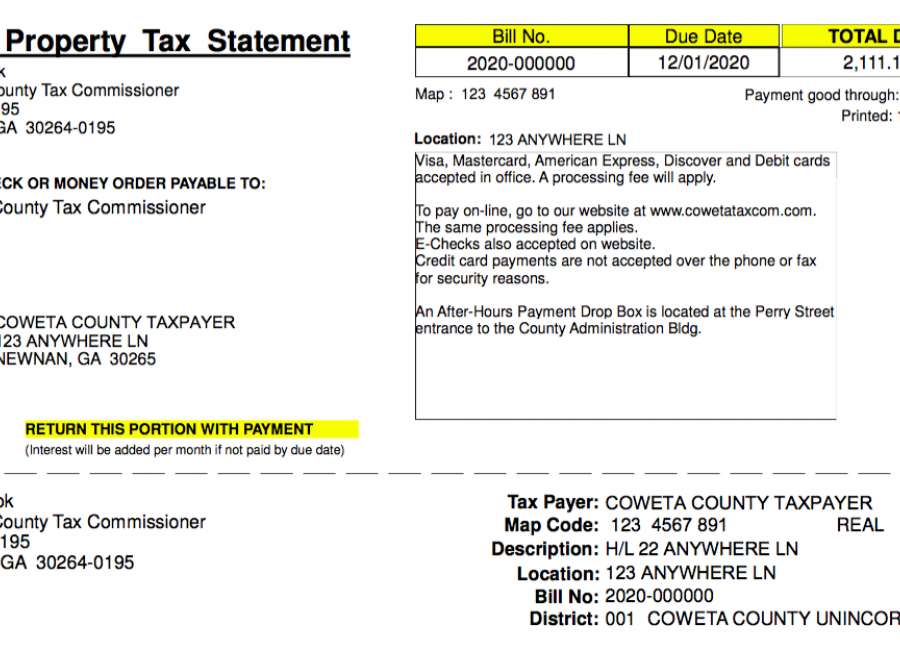

coweta county property tax due date

In the Conference room of the Board of Assessors office located at 37 Perry St building Entrance D. The Coweta County GA Website is not responsible for the content of external sites.

Learn About Owners Year Built More.

. Beginning in 2015 all Coweta County residents will receive one tax bill annually due and payable to the Coweta County Tax Commissioner by December 1st. You will be redirected to the destination page below in 3 seconds. Dispose of my Trash.

The county anticipates adopting the millage rate on Aug. If you wish to attend please confirm the schedule directly with the office. Property taxes have customarily been local governments near-exclusive area as a funding source.

Taxes due the state and county are not only against the owner BUT also against the property regardless of judgments mortgages sales or encumbrances. Property tax bills are based on the calendar year in. Thank you for visiting the Coweta County GA Website.

Coweta County GA. Coweta County Board of Commissioners - 22 East Broad Street Newnan GA 30263. Together with Coweta County they count on real property tax receipts to perform their public services.

The Board of Assessors typically meets the first and third Wednesday of each month at 900 AM. Georgia depends on property tax income a lot. Coweta County GA Website Home Menu.

The tax increase is because of a sharp increase in the value of real and personal property in Coweta County from 2021 to 2022. Website Design by Granicus - Connecting People and. NOTICE OF PROPERTY TAX INCREASE.

The total value of property assessed in the county in 2022 is around 79 billion up from 64 billion in 2021 and 61 billion in 2020. However as a condition to receiving such an extension the county board of tax assessors shall at least 30 days before the expiration of the 180 day period provided under subparagraph A of this paragraph notify each affected taxpayer of the additional 180 day review period provided in this subparagraph by mail or electronic communication including posting notice on the. Beginning in 2015 City of Newnan property taxes have been billed and collected by the Coweta County Tax Commissioner.

Beginning in 2015 all Coweta County residents will receive one tax bill annually due and payable to the Coweta County Tax Commissioner by December 1st. Coweta County collects on average 081 of a propertys assessed fair market value as property tax. Dispose of my Trash.

Thank you for visiting the Coweta County GA Website. The digest is used by the various local taxing authorities the Coweta County Commissioners Board of Education and city councils to set the property tax millage rate and property taxes are due in late 2020. The City of Newnan will no longer bill and collect city taxes seperately.

Property or Ad Valorem Taxes Sales Taxes ELOST SPLOST FinesForfeitures. Funding sources for Coweta County include. Find Details on Coweta County Properties Fast.

Coweta County property taxes are due Dec. Coweta County Board of Commissioners - 22 East Broad Street Newnan GA 30263. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900.

You are now exiting the Coweta County GA Website. Taxes constitute a general lien upon all property of a taxpayer within the State of Georgia and the lien attaches on January 1st of each tax year even though a fi. You are now exiting the Coweta County GA Website.

Coweta County GA Website Home Menu. How Do You Look Up The Assessed Value of a Property. NOTICE OF PROPERTY TAX INCREASE.

Property tax returns must be filed with the county tax office between January 1 and April 1 of each year. Thank you for visiting the Coweta County GA Website. Website Design by Granicus - Connecting People and Government.

To find the assessed value of a property in Coweta County the Chief Appraisers Office offers an online property records search tool to help you find the information online. Prior to that year City residents received two separate tax bills with two different due dates. There are three vital steps in taxing property ie formulating tax rates appraising property market worth and collecting payments.

Georgia is ranked 841st of the 3143 counties in the United States in order of the median amount of property taxes collected. Ad Need Property Records For Properties In Coweta County. Georgia communities count on the real estate tax to fund public services.

SEARCH AND PAY PROPERTY TAXES. Now all Coweta County residents and businesses receive one tax bill due and payable by December 1st to the Coweta County Tax Commissioner. The Tax Commissioner of Coweta County sends one tax bill due and payable by December 1st to all residents and businesses in the county.

They all are public governing bodies administered by elected or appointed officers. Has not been issued. The Coweta County GA Website is not responsible for the content of external sites.

Taxing authorities include Coweta county governments and numerous special districts eg. You are now exiting the Coweta County GA Website. The Coweta County GA Website is not responsible for the content of external sites.

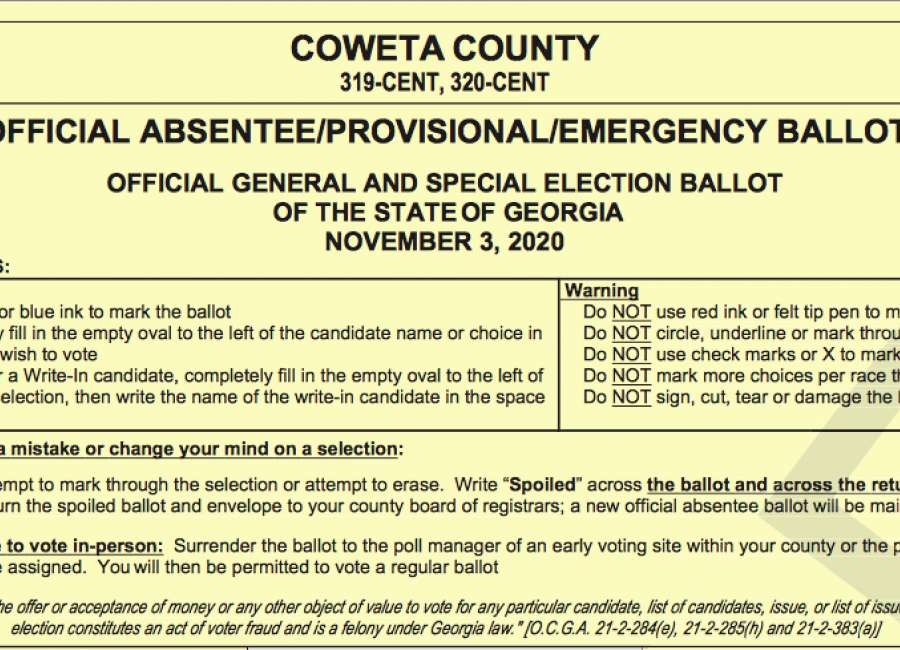

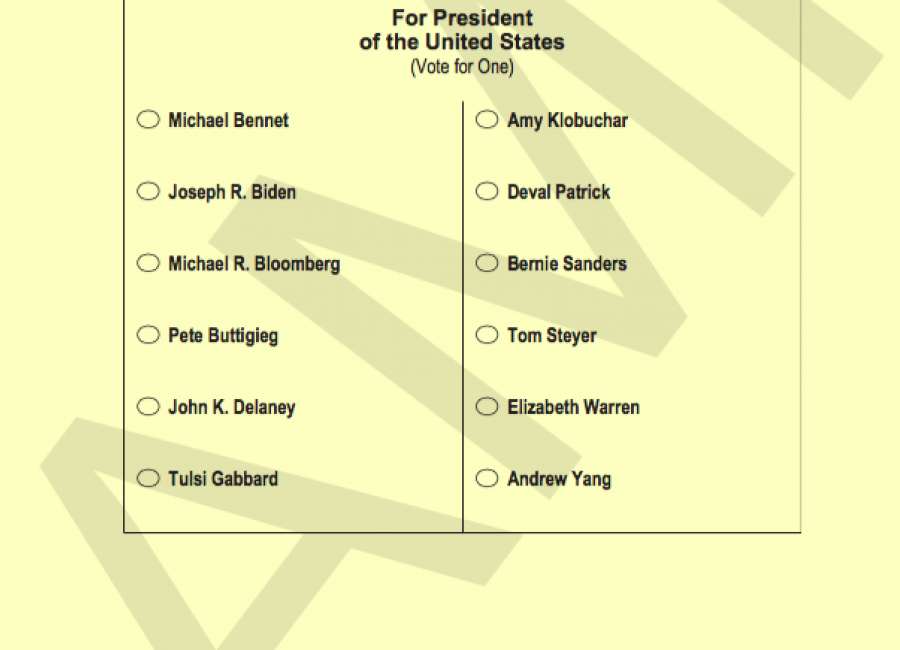

Voting Registration Deadline Approaching Early Voting Starts Oct 12 The Newnan Times Herald

Voter Registration Deadline In Feb 24 More Voting Demos Coming Up The Newnan Times Herald

2021 Dog Bite Fatality Pit Bulls Kill Man After He Entered A Home In Coweta County Georgia Dogsbite Blog

Reliable Support From A Qualified Accountancy Firm In London Services Business Services Tax Advisers Payroll C Certified Accountant Accounting Payroll

Reliable Support From A Qualified Accountancy Firm In London Services Business Services Tax Advisers Payroll C Certified Accountant Accounting Payroll